The Great Fire of 1666 devastated central London, and our galleries tell the story of the damage and rebuilding. But a series of objects from the museum's collection tells of one surprising outcome of the fire: the creation of modern property insurance.

Print from Shlohavot, or, The burning of London in the year 1666

Published by Samuel Rolle, 1667; ID no. 42.39/56

The Great Fire devastated London. There were few recorded deaths, but estimates put the destroyed property value at £10,000,000 (£1.5 billion in today’s money). From the ashes rose an unlikely development: the world’s first property insurance policies.

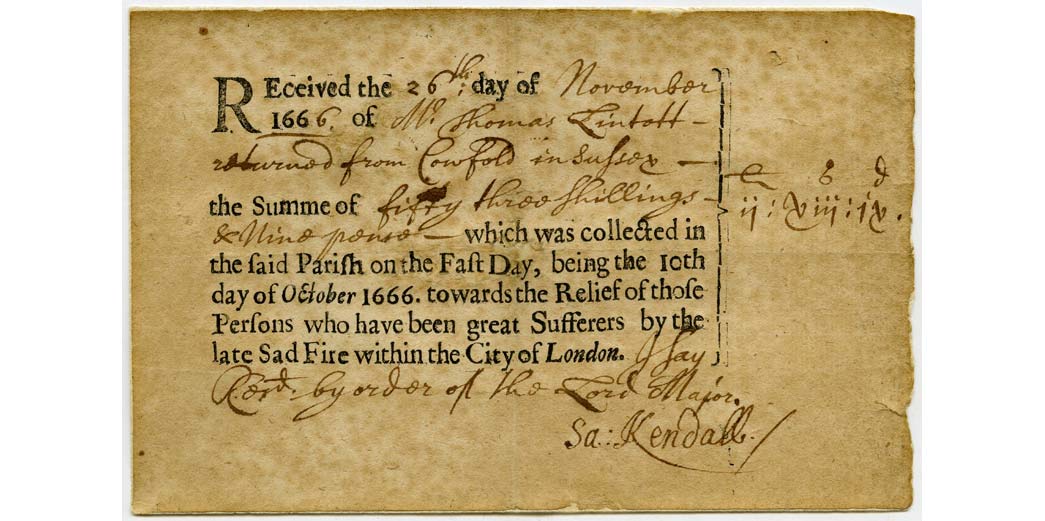

Charity begins in the home counties

After the fire much of London needed to be rebuilt. King Charles II declared there would be collections at churches across the country for the Lord Mayor of London to distribute amongst homeless and destitute Londoners. This receipt shows that the village of Cowfold donated 53 shillings and 9 pence (around £400 today), on 26th November 1666. We know the total raised throughout the country was over £16,400 – covering a whopping 0.13% of the damage.

It seems that the country was suffering 'donation fatigue' as only the year before it had been asked for money to help London recover from the Great Plague. People were also poor after the recent plague and civil war. Matters were not helped by the Lord Mayor, Sir William Bolton, allegedly embezzling £1800 from the fund.

Landlords and order

Renting in London is bad enough today, but in 1666 the contracts of tenants made them liable for repairs to their houses, not the landlords who owned the property. Tenants were also supposed to pay rent while their burned houses were being rebuilt. This was clearly untenable and so an emergency ‘Fire Court’ was set up to sort out disputes that arose out of the rebuilding, such as who should pay to rebuild. The inscription shows that this table was use by judges “in Cliffords Inn to determine the disputes respecting Property”. The judges had the power to decide who should rebuild, based on ability to pay, and could cancel contracts. This stopped disputes from dragging on and enabled Londoners to rebuild as soon as possible. The Court sat in Cliffords Inn and held its first session on 27 February 1667 and last in September 1672.

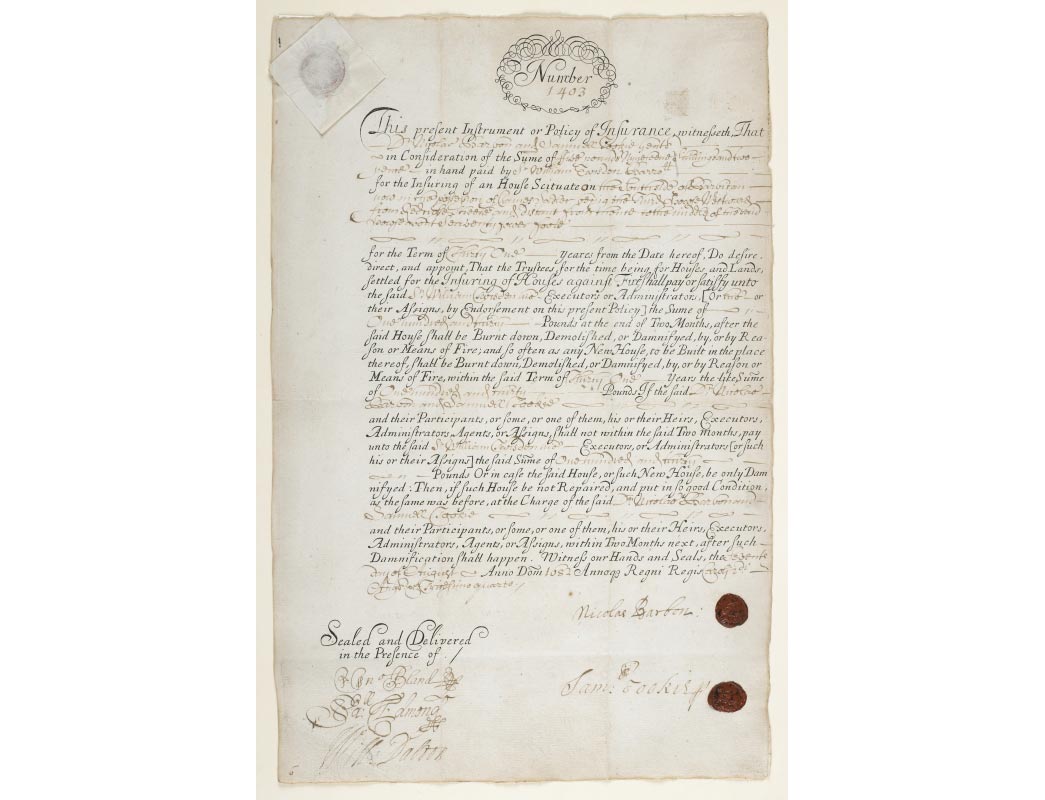

Safe as houses

There’s nothing like a giant, city-destroying conflagration to get people thinking about better fire safety and measures to pay for repairs. And so, in 1680 the first insurance company, the ‘Fire Office’, was set up by Nicholas Barbon. This is one of the first property insurance policies (no. 1403) for a house in the Barbican (signed by Barbon himself). Other insurance companies were soon set up as well and by 1690 one in ten houses in London was insured.

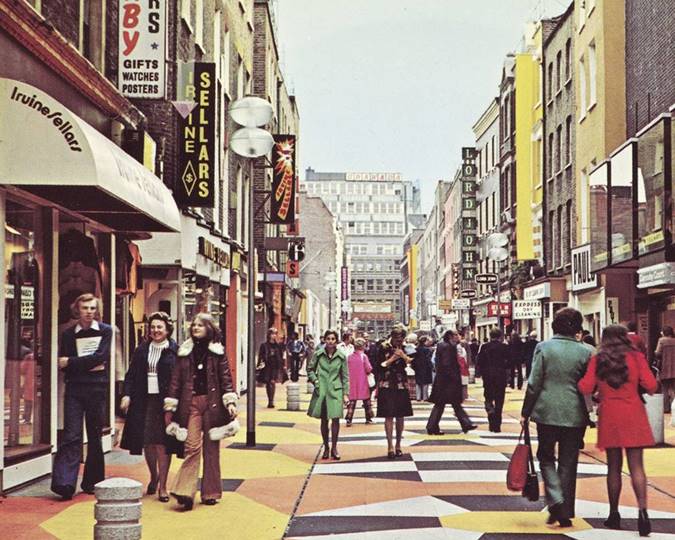

Marked houses

By 1700 companies had realised that it would probably be cheaper to put out the fires more effectively than pay for rebuilds. And so they began to employ their own fire brigades. The insurers created ‘fire mark’ plates, such as this one, in order to identify which houses were insured by each company when the fire brigades arrived. This identification was particularly important in London before the introduction of street numbering in the 1760s. Insurance companies often had reciprocal arrangements with each other, so that if a fire brigade put out a fire at a house insured by another company then the brigade’s company would be reimbursed.

One brigade to rule them all

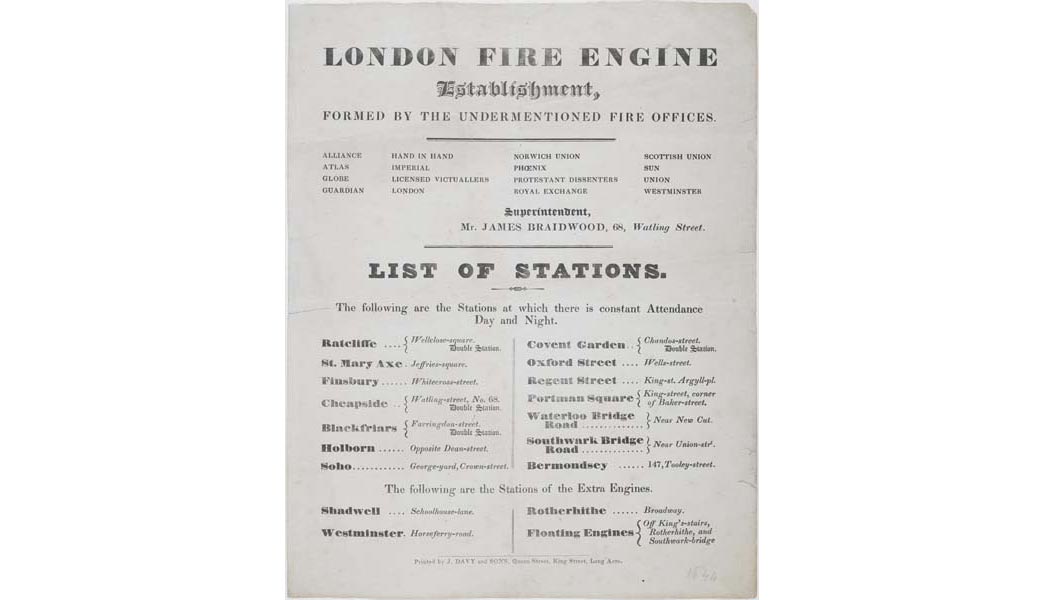

Before long the major insurers realised it would be more efficient to have single, unified force to watch over London, and so in 1833 the London Fire Engine Establishment was created. This notice lists all London fire stations with constant ‘attendance day and night’ across 17 key locations throughout central London, the City and east and south London. It also notes three ‘floating engines’ on the Thames, which could be used to extinguish fires in the docks (oil and tallow in the warehouses had been a major accelerant in the Great Fire, according to Samuel Pepys).

Under cover

Reacting to demand, more and more insurers set up shop in London. This fire mark was issued by the Sun Fire Office, which would later become Royal Sun Alliance, which still exists today as RSA Insurance Group. By 1720 they had underwritten 17,000 policies totalling £10 million – enough to cover the estimated cost of property that the Great Fire had destroyed.